What is a VA Loan Funding Fee?

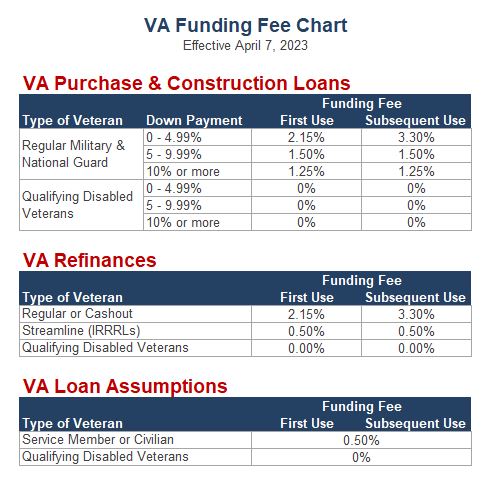

The VA Funding Fee is paid directly to the Federal Government to help ensure that the program keeps running for future generations. The amount of the funding fee varies based on a number of factors including down payment amount; disability status; and how many times a Veteran has used their VA loan benefit.

VA Loans, are not unique in charging a fee like this. For all intents and purposes, the VA funding fee is a form of mortgage insurance. All government loans, including USDA and FHA loans, have similar fees associated with them. For comparison:

- VA charges a one-time “funding fee” that ranges from 0% to 3.6% (see above). The funding fee can be financed. There is NO monthly mortgage insurance charged.

- USDA charges a one-time “guarantee fee” of 1% PLUS .35% every single year (added to the monthly payment).

- FHA charges a one-time “upfront mortgage insurance premium” of 1.75% PLUS.85% every single year (added to the monthly payment).

- Conventional loans offer multiple “private mortgage insurance” or PMI options. You might pay upfront PMI, monthly PMI or split PMI which is a combination of both. Conventional loans do not require PMI if you put at least 20% down.

Notice above that both USDA and FHA loans have monthly mortgage insurance on top of the upfront fees added to the loan, whereas VA loans do not. FHA and conventional loans also require a down payment whereas the VA loan does not.

The right or wrong mortgage can change your financial future and we are never too busy to answer your questions. Call us today. (208) 287-1705 or get started online by clicking on the apply buttons on the right.

or

or