The Advantages and Benefits of VA Home Loans

The VA home loans are one of the most buyer-friendly home loans available today. From flexible qualifying guidelines and zero down payment options to low monthly payments, it’s making homeownership available to many military families who would otherwise not be able to afford to buy.

Why is this loan so popular? It has a number of unique benefits:

1) No Loan Limit!

There is no VA Loan Limit set by the Veteran’s Administration! Qualifying Veterans with full entitlement can borrow as much as a lender is willing to lend without the need for a down payment. This is one of the many provisions included in the Blue Water Navy Veterans Act that went into effect on January 1st, 2020.

2) No Down Payment

One of the main obstacles to purchasing a home for many families is saving for the down payment. Unique to the VA loan is the option for qualified buyers to finance 100% of the home’s value.

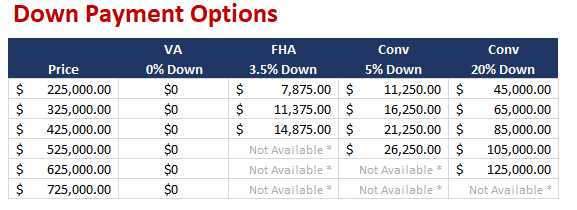

Let’s compare the VA Program to other Loans Available:

* Not available due to Loan Limit Regulations on FHA & Conventional Loans (some high-cost areas might be exceptions)

3) No Monthly Mortgage Insurance

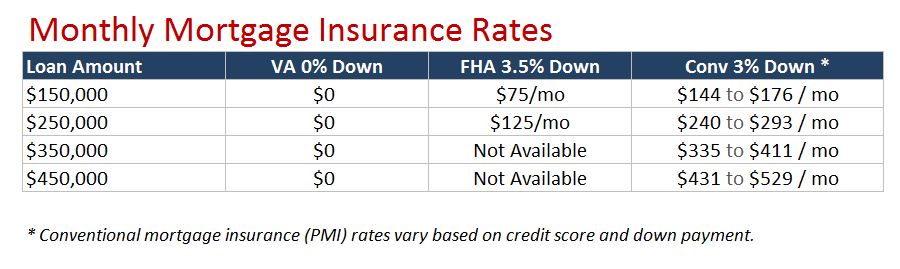

On conventional loans, private mortgage insurance protects the lender in case the borrower defaults on their loan. Most conventional loans require the borrower to pay for private mortgage insurance unless they put at least 20 percent down.

FHA loans, which offer 3.5% down payment options, require monthly mortgage insurance for the life of the loan.

The VA loan can save the veteran thousands of dollars over the life of the loan because as you can see in the chart below they have no monthly mortgage insurance, making the payment much more affordable.

4) Competitive Interest Rates

VA home loans are backed by the Federal government and as such the risk to the lender is greatly reduced. Because of this, lenders typically offer better rates on VA loans than on conventional loans. When this factors in with zero down and no monthly mortgage insurance, the savings start adding up quickly.

5) No Prepayment Penalty

Some loan programs penalize borrowers for paying their loan off early by charging extra fees when they do. The VA loan allows the borrower to pay the loan off partially or in full at any time allowing them to save money on interest and/or consider selling without incurring extra fees.

The right or wrong loan program can change your financial future. We are never too busy to answer your questions. Call us today. (208) 287-1705 or get started online.